In today’s complex financial landscape, smart investing has become essential for building long-term wealth and securing your financial future. Whether you’re just starting your investment journey or looking to optimize your existing portfolio, understanding the fundamentals of strategic investing can make a significant difference in your financial outcomes. This comprehensive guide explores the principles, strategies, and practical steps for smart investing, helping you navigate market complexities with confidence.

Smart investing isn’t about finding “get-rich-quick”;; schemes or timing the market perfectly. Instead, it’s about making informed decisions based on sound financial principles, understanding your personal goals, and implementing proven strategies that stand the test of time. By adopting a thoughtful approach to investing, you can build wealth steadily while managing risks effectively.

Understanding the Foundations of Smart Investing

What Is Smart Investing?

Smart investing involves making strategic financial decisions that align with your goals, risk tolerance, and time horizon. Unlike speculative trading or gambling, smart investing focuses on creating sustainable wealth through disciplined approaches and evidence-based strategies.

At its core, smart investing requires:

- Clear financial objectives: Defining what you’re investing for, whether it’s retirement, education funding, home purchase, or general wealth building

- Risk assessment: Understanding your personal comfort level with market fluctuations

- Knowledge acquisition: Learning the basics of different asset classes and investment vehicles

- Strategic planning: Creating a diversified portfolio aligned with your goals

- Patience and discipline: Maintaining a long-term perspective despite market volatility

Why Invest?

Investing serves multiple purposes in your financial journey:

- Beat inflation: While savings accounts provide security, they rarely keep pace with inflation. Investing helps your money grow faster than the rising cost of living.

- Build wealth: Through the power of compounding, investments can generate substantial returns over time.

- Achieve financial goals: Strategic investing provides the means to fund major life milestones and aspirations.

- Create passive income: Certain investments can generate regular income streams without active work.

- Secure retirement: Investment growth is crucial for building a sufficient retirement nest egg.

As one financial expert notes: “The goal of investing is to build wealth over time and outpace inflation with reinvested earnings.”;;

Essential Investment Principles

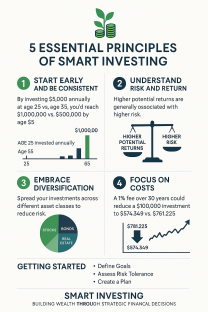

1. Start Early and Be Consistent

Time is perhaps the most powerful factor in investing success. The sooner you begin, the more you benefit from compoundingâthe process where your investment returns generate their own returns.

Consider this: If you invest $5,000 annually starting at age 25, with an average 7% return, you’ll have approximately $1,000,000 by age 65. Wait until age 35 to start, and you’ll have just $500,000âhalf the amount despite only delaying ten years.

Consistency is equally important. Regular investing through methods like dollar-cost averaging (investing fixed amounts at regular intervals) helps reduce the impact of market volatility and removes the emotional challenges of timing the market.

2. Understand Risk and Return

Every investment carries some level of risk, and generally, higher potential returns come with higher risks. Understanding this relationship is fundamental to smart investing.

Common investment risks include:

- Market risk: Overall market declines affecting most investments

- Inflation risk: The possibility that returns won’t keep pace with inflation

- Liquidity risk: Difficulty selling an investment quickly without substantial loss

- Concentration risk: Having too much invested in a single asset or sector

- Longevity risk: Outliving your retirement savings

Your personal risk toleranceâyour emotional and financial ability to withstand investment lossesâshould guide your investment choices. Generally, younger investors can accept higher risks due to longer recovery time horizons, while those approaching retirement may prefer more conservative approaches.

3. Embrace Diversification

Diversificationâspreading investments across various asset classes, sectors, and geographic regionsâis a cornerstone of smart investing. This strategy helps manage risk by ensuring that poor performance in one area doesn’t devastate your entire portfolio.

Effective diversification includes:

- Asset class diversification: Spreading investments across stocks, bonds, real estate, and potentially alternative investments

- Sector diversification: Investing across different industries within stock allocations

- Geographic diversification: Including both domestic and international investments

- Time diversification: Staggering investment entry points to avoid making large investments at market peaks

Remember that proper diversification doesn’t mean owning countless investments. Rather, it means thoughtfully allocating assets to achieve balanced exposure to different market segments.

4. Focus on Costs

Investment costs can significantly erode returns over time. Even seemingly small expense ratios and fees compound dramatically over decades.

For example, a $100,000 investment growing at 7% annually would be worth $761,225 after 30 years with no fees. With a 1% annual fee, that same investment would grow to just $574,349ânearly $187,000 less.

Smart investors minimize costs by:

- Choosing low-cost index funds and ETFs when appropriate

- Understanding all fees, including expense ratios, transaction costs, and advisory fees

- Considering tax implications of investment decisions

- Limiting unnecessary trading that generates costs without clear benefits

Building Your Investment Portfolio

Assessing Your Financial Situation

Before investing, ensure your financial foundation is solid:

- Emergency fund: Establish savings covering 3-6 months of essential expenses

- Debt management: Consider addressing high-interest debt before significant investing

- Insurance coverage: Secure appropriate health, disability, and life insurance

- Clear goals: Define specific financial objectives with timeframes

Asset Allocation: The Critical Decision

Asset allocationâhow you divide investments among stocks, bonds, cash, and other asset classesâis arguably the most important investment decision you’ll make. Research suggests it accounts for more than 90% of a portfolio’s return variability.

Your ideal asset allocation depends on:

- Time horizon: How long until you need the money

- Risk tolerance: Your comfort with investment volatility

- Financial goals: What you’re trying to achieve

- Current financial situation: Your income, savings, and other resources

A common starting guideline suggests subtracting your age from 110 to determine an appropriate stock percentage (e.g., a 30-year-old might consider approximately 80% in stocks). However, this oversimplified approach should be refined based on your specific circumstances.

Core Investment Vehicles

Smart investors typically utilize several key investment vehicles:

1. Stocks (Equities)

Stocks represent ownership in companies and offer growth potential through price appreciation and dividends. They generally provide higher long-term returns than other asset classes but with greater short-term volatility.

Stock investments can be made through:

- Individual stocks: Buying shares in specific companies

- Stock mutual funds: Professionally managed collections of many stocks

- Exchange-traded funds (ETFs): Baskets of stocks that trade like individual shares

- Index funds: Funds that passively track specific market indexes

For most investors, especially beginners, diversified funds are preferable to individual stock picking, offering broader exposure with reduced company-specific risk.

2. Bonds (Fixed Income)

Bonds are essentially loans to governments, municipalities, or corporations, providing regular interest payments and return of principal at maturity. They typically offer lower returns than stocks but with reduced volatility, making them important for portfolio stabilization.

Bond investments include:

- Government bonds: Issued by federal governments (e.g., U.S. Treasuries)

- Municipal bonds: Issued by states, cities, or counties

- Corporate bonds: Issued by companies

- Bond funds and ETFs: Collections of bonds offering diversification

Bond quality (risk of default) is assessed through ratings from agencies like Moody’s and Standard & Poor’s, with higher-rated bonds offering more security but lower yields.

3. Cash and Cash Equivalents

This category includes highly liquid, low-risk investments like:

- High-yield savings accounts

- Money market funds

- Certificates of deposit (CDs)

- Treasury bills

While these provide minimal returns, they offer capital preservation and liquidity for emergency funds and short-term goals.

4. Real Estate

Real estate investments can provide both growth through appreciation and income through rental payments. Options include:

- Direct property ownership: Residential or commercial properties

- Real Estate Investment Trusts (REITs): Companies that own or finance income-producing real estate

- Real estate mutual funds and ETFs: Diversified collections of real estate-related investments

5. Alternative Investments

For more sophisticated investors, alternatives like private equity, hedge funds, commodities, and cryptocurrency might be considered for further diversification. However, these typically involve higher risks, costs, and complexity.

Smart Investment Strategies for Different Life Stages

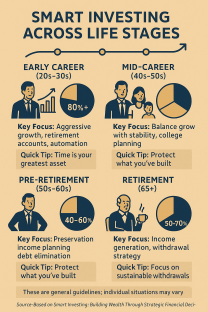

Early Career (20s-30s)

Young investors benefit from their longest assetâtimeâand can generally adopt growth-oriented strategies:

- Aggressive asset allocation: Consider higher equity exposure (80%+ in stocks)

- Retirement focus: Maximize contributions to tax-advantaged accounts like 401(k)s and IRAs

- Human capital investment: Invest in education and skills that increase earning potential

- Debt reduction: Eliminate high-interest debt while building investment habits

- Automation: Set up automatic contributions to enforce saving discipline

Mid-Career (40s-50s)

This stage typically brings higher earning power along with growing responsibilities:

- Balancing asset allocation: Moderately high equity exposure (60-70% in stocks) with increasing bond allocation

- College planning: Investing for children’s education if applicable

- Catch-up contributions: Maximizing retirement contributions, including catch-up options after age 50

- Tax efficiency: Strategic use of tax-advantaged accounts and investment placement

- Estate planning: Beginning basic estate planning, including wills and insurance

Pre-Retirement (50s-60s)

As retirement approaches, preservation becomes increasingly important:

- Conservative growth focus: Moderate equity exposure (40-60% in stocks) with higher quality fixed income

- Retirement income planning: Developing strategies for generating retirement income

- Healthcare consideration: Planning for healthcare costs, including long-term care

- Social Security optimization: Understanding claiming strategies for maximizing benefits

- Debt elimination: Working to enter retirement debt-free

Retirement (65+)

During retirement, the focus shifts to income generation and preservation:

- Income-oriented allocation: Conservative equity exposure (30-50% in stocks) with significant high-quality bonds

- Withdrawal strategy: Implementing sustainable withdrawal rates (typically 3-4% initially)

- Required Minimum Distributions (RMDs): Managing mandatory withdrawals from tax-deferred accounts

- Tax-efficient withdrawals: Strategic use of different account types to minimize taxes

- Legacy planning: Finalizing estate plans and considering charitable giving

Essential Smart Investing Strategies

Dollar-Cost Averaging

This strategy involves investing fixed amounts at regular intervals, regardless of market conditions. Benefits include:

- Eliminating the stress of timing market entry

- Automatically purchasing more shares when prices are lower

- Enforcing investment discipline

- Reducing the impact of market volatility

For example, investing $500 monthly into a diversified fund rather than trying to time a $6,000 annual investment.

Portfolio Rebalancing

As market movements cause your asset allocation to drift from targets, rebalancingâselling outperforming assets to purchase underperforming onesâmaintains your desired risk level. This disciplined approach enforces “buying low and selling high.”;;

Consider rebalancing:

- On a regular schedule (annually or semi-annually)

- When allocations drift beyond predetermined thresholds (e.g., 5% from targets)

- After significant market movements or life changes

Tax-Efficient Investing

Minimizing tax impact can significantly improve long-term returns:

- Tax-advantaged accounts: Maximize contributions to 401(k)s, IRAs, and HSAs

- Asset location: Hold tax-inefficient investments (like bonds) in tax-advantaged accounts

- Tax-loss harvesting: Strategically realizing losses to offset gains

- Long-term holding: Maintaining positions for more than one year for preferred capital gains rates

- Tax-efficient funds: Utilizing ETFs and funds with low turnover and tax-efficient structures

Value Averaging

This sophisticated variation of dollar-cost averaging involves adjusting contribution amounts to reach specific portfolio value targets at predetermined intervals. While more complex, it can enhance returns by increasing investments during market declines and reducing them during upswings.

Navigating Market Volatility

Market volatilityâthe inevitable ups and downs of investment valuesâchallenges even experienced investors emotionally. Smart investing requires strategies for managing these fluctuations:

Understanding Normal Volatility

Stock markets have historically experienced:

- Corrections (10%+ declines) approximately once yearly

- Bear markets (20%+ declines) approximately every 3-5 years

- Positive returns in approximately 70% of calendar years

Recognizing these patterns as normal rather than exceptional helps maintain perspective during declines.

Behavioral Finance Awareness

Understanding common psychological biases helps avoid costly mistakes:

- Loss aversion: The tendency to feel losses more strongly than equivalent gains

- Recency bias: Overweighting recent events in decision making

- Herd mentality: Following the crowd rather than sticking to personal strategy

- Overconfidence: Overestimating one’s ability to predict market movements

- Confirmation bias: Seeking information that confirms existing beliefs

Practical Volatility Management

During market turbulence:

- Revisit your plan: Confirm your strategy remains appropriate for your goals

- Avoid media overexposure: Limit consumption of sensationalized financial news

- Consider rebalancing: Use significant downturns as rebalancing opportunities

- Maintain perspective: Focus on long-term historical patterns rather than short-term movements

- Continue regular investments: Stick with dollar-cost averaging through market cycles

Remember that market timingâattempting to move in and out of investments based on predicted movementsâhas proven virtually impossible to execute successfully over time.

Common Investment Mistakes to Avoid

1. Chasing Performance

Investing heavily in last year’s top-performing assets often leads to disappointment, as performance tends to be cyclical rather than persistent. Instead of chasing yesterday’s winners, maintain disciplined allocation across diverse assets.

2. Neglecting Diversification

Concentrating investments in familiar companies, sectors, or countries increases unnecessary risk. True diversification means owning assets that perform differently under various economic conditions.

3. Emotional Decision-Making

Making investment changes based on fear during market declines or greed during bubbles typically harms long-term results. Developing and following an investment policy statement helps maintain discipline.

4. Ignoring Fees and Taxes

Small-seeming expenses compound dramatically over time. Be vigilant about expense ratios, trading costs, advisory fees, and tax implications of investment decisions.

5. Inadequate Knowledge

Investing in complex products you don’t fully understand increases risk substantially. Stick with investments whose risks and characteristics you comprehend thoroughly.

Building Your Investment Knowledge

Smart investing requires continuous learning. Consider these resources for expanding your investment understanding:

Educational Resources

- Books: Classics like “The Intelligent Investor”;; by Benjamin Graham, “A Random Walk Down Wall Street”;; by Burton Malkiel, and “The Little Book of Common Sense Investing”;; by John Bogle

- Online courses: Many universities and financial institutions offer free or low-cost investing courses

- Government resources: The SEC’s investor.gov provides reliable educational content

- Financial media: Quality sources like The Wall Street Journal, Financial Times, and specialized investment publications

Professional Guidance

Consider whether professional advice would benefit your situation:

- Robo-advisors: Automated platforms offering low-cost portfolio management based on algorithms

- Financial advisors: Professionals providing personalized investment guidance and planning

- Fee structures: Understanding different compensation models (fee-only, commission-based, or hybrid)

When selecting advisors, verify credentials (such as CFP®, CFA, or RIA designations), understand fee structures completely, and confirm fiduciary responsibility to put your interests first.

Advanced Smart Investing Concepts

As your wealth and knowledge grow, consider these more sophisticated approaches:

Factor Investing

Factor investing involves targeting specific “factors”;; (characteristics) associated with higher returns, such as:

- Value: Companies trading at lower prices relative to fundamentals

- Size: Smaller companies that may outperform larger ones over time

- Momentum: Securities showing positive price trends

- Quality: Companies with strong balance sheets and stable earnings

- Volatility: Securities with lower price fluctuations

These factors can be accessed through specialized ETFs and mutual funds.

Sustainable Investing

Also known as ESG (Environmental, Social, and Governance) investing, this approach considers non-financial factors alongside traditional metrics:

- Environmental: Climate impact, resource usage, pollution

- Social: Employee relations, community engagement, human rights

- Governance: Management structure, executive compensation, shareholder rights

Research increasingly suggests that strong ESG practices correlate with better risk-adjusted returns over time.

Direct Indexing

This approach involves directly owning individual securities that comprise an index rather than purchasing fund shares. Benefits can include:

- Customized exposure by excluding certain companies or sectors

- Enhanced tax-loss harvesting opportunities

- Potential fee savings for larger portfolios

Technology advances have made this previously high-net-worth strategy increasingly accessible.

The Path to Financial Independence

For many, smart investing ultimately serves the goal of financial independenceâhaving sufficient resources to live without requiring employment income. This concept transcends traditional retirement planning by focusing on freedom rather than age.

Calculating Your Number

Financial independence typically requires assets generating sufficient passive income to cover expenses. A common calculation guideline:

- Determine annual expenses

- Multiply by 25 (based on a 4% sustainable withdrawal rate)

- The resulting figure represents the approximate assets needed

For example, $60,000 in annual expenses would suggest approximately $1.5 million in required assets.

Accelerating Your Journey

Strategies for expediting financial independence include:

- Increasing savings rate: The single most powerful factor in building wealth quickly

- Optimizing investment returns: Ensuring appropriate asset allocation for your timeframe

- Reducing expenses: Examining lifestyle costs without sacrificing true quality of life

- Growing income: Developing additional income streams through career advancement, side businesses, or passive income sources

- Tax optimization: Maximizing tax-advantaged accounts and minimizing investment-related taxes

Conclusion: Your Smart Investing Journey

Smart investing isn’t about finding shortcuts or getting rich overnightâit’s about making thoughtful financial decisions aligned with your goals and circumstances. By understanding fundamental principles, avoiding common pitfalls, and maintaining a long-term perspective, you can build wealth steadily and achieve financial security.

Remember that investing success rarely comes from complex strategies or perfectly timing markets. Instead, it stems from simple but powerful practices: starting early, staying consistent, keeping costs low, maintaining appropriate diversification, and avoiding behavioral mistakes during market turbulence.

Your smart investing journey will be uniquely yours, reflecting your personal goals, risk tolerance, and financial situation. With patience, discipline, and continuous learning, you can navigate the inevitable market fluctuations while building lasting wealth and working toward your definition of financial success.

Taking Action: Next Steps for Smart Investing

- Define your financial goals: Clarify what you’re investing for and your timeframes

- Assess your current situation: Analyze existing savings, investments, and debt

- Determine your risk tolerance: Honestly evaluate your emotional and financial capacity for volatility

- Create an investment plan: Develop an asset allocation strategy aligned with your goals and risk tolerance

- Implement systematically: Set up accounts and regular contribution mechanisms

- Review periodically: Assess progress and rebalance as needed, ideally annually

- Continue learning: Regularly expand your investment knowledge through quality resources

By taking these concrete steps, you’ll be well on your way to smart investing success and long-term financial security.