If you’re tired of checking your bank account and seeing tumbleweeds instead of cash, you’re not alone. Between inflation hitting different, student loans that feel like a lifetime commitment, and rent prices that make you question reality, saving money feels impossible sometimes.

But here’s the tea: building wealth isn’t just for trust fund kids or crypto bros who got lucky. With the right money-saving strategies and a little discipline (we know, we know), you can actually start building a solid financial foundation that’ll have you sleeping better at night.

Whether you’re trying to save for that dream apartment, planning your first real vacation, or just want to stop living paycheck to paycheck, this guide has everything you need to level up your money game without giving up everything you love.

Understanding the Importance of Saving Money

Saving money isn’t just about having extra cash in your bank account â it’s about creating financial freedom and peace of mind. When you build a solid savings foundation, you’re protecting yourself from unexpected expenses, creating opportunities for future investments, and reducing financial stress that can impact every area of your life.

The psychology of money saving shows that people who save regularly develop better financial habits overall. They become more conscious spenders, better planners, and more confident in their financial decisions. This mindset shift from spending to saving creates a positive cycle that builds momentum over time.

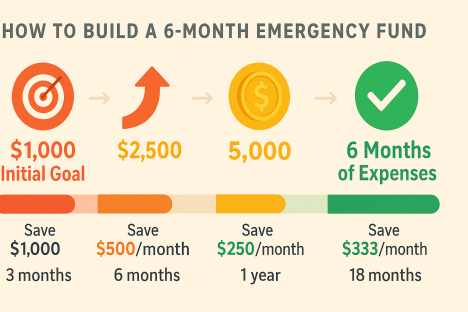

Emergency fund importance cannot be overstated. Financial experts recommend having 3-6 months of expenses saved for emergencies. This safety net protects you from going into debt when unexpected costs arise, such as medical bills, car repairs, or job loss.

25 Proven Money-Saving Strategies

1. Create a Realistic Budget That Actually Works

Budgeting doesn’t have to be complicated or restrictive. The key is creating a system that works with your lifestyle, not against it. Start with the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Use budgeting apps like Mint, YNAB (You Need A Budget), or even simple spreadsheet templates to track your income and expenses. The goal is to know where every dollar goes before you spend it.

Budget categories to consider:

- Housing (rent, utilities, insurance)

- Transportation (car payment, gas, maintenance)

- Food (groceries, dining out)

- Entertainment and hobbies

- Savings and investments

- Debt payments

2. Master the Art of Meal Planning and Cooking at Home

Food expenses can quickly drain your budget if you’re not careful. The average American spends over $3,500 annually on dining out. By cooking at home and meal planning, you can reduce food costs by 60-70%.

Meal planning strategies:

- Plan weekly menus before grocery shopping

- Buy generic brands when possible

- Use coupons and cashback apps

- Cook in bulk and freeze portions

- Grow herbs and simple vegetables if possible

Money-saving cooking tips:

- Learn basic cooking skills through free YouTube tutorials

- Invest in versatile kitchen tools

- Use less expensive protein sources like beans and eggs

- Repurpose leftovers into new meals

3. Eliminate Unnecessary Subscriptions and Memberships

Subscription services can add up quickly. The average person has 12 paid subscriptions, spending about $273 monthly. Audit your subscriptions every three months and cancel unused services.

Common subscription categories to review:

- Streaming services (Netflix, Hulu, Disney+)

- Music platforms (Spotify, Apple Music)

- Fitness apps and gym memberships

- Software subscriptions

- Magazine and news subscriptions

- Beauty boxes and monthly deliveries

4. Find Better Deals on Insurance

Insurance is a necessary expense, but you don’t have to overpay. Shop around annually for auto, health, and renters insurance. Many people can save hundreds of dollars by switching providers or adjusting coverage.

Insurance saving strategies:

- Bundle policies for discounts

- Increase deductibles to lower premiums

- Maintain good credit scores for better rates

- Take advantage of safe driving discounts

- Consider usage-based insurance programs

5. Reduce Transportation Costs

Transportation is often the second-largest expense after housing. Look for ways to reduce these costs without sacrificing convenience.

Transportation savings:

- Use public transit when available

- Bike or walk for short distances

- Carpool or use rideshare services

- Maintain your vehicle properly to avoid costly repairs

- Consider a more fuel-efficient vehicle

- Work from home when possible

6. Shop Smart with Coupons and Cashback

Modern couponing isn’t about clipping newspaper ads. Digital coupons and cashback apps make saving money easier than ever.

Best money-saving apps:

- Rakuten for online cashback

- Ibotta for grocery cashback

- Honey for automatic coupon codes

- Checkout 51 for grocery rebates

- Receipt Hog for receipt scanning

7. Practice the 24-Hour Rule for Major Purchases

Impulse buying destroys budgets. Before making any non-essential purchase over $100, wait 24 hours. For larger purchases, wait a week. This cooling-off period helps you decide if you really need the item.

8. Find Free and Low-Cost Entertainment

Entertainment doesn’t have to be expensive. Many cities offer free events, museums have discount days, and outdoor activities provide excellent entertainment value.

Free entertainment ideas:

- Local festivals and events

- Free museum days

- Hiking and outdoor activities

- Community center classes

- Library programs and resources

- Free concerts and performances

9. Master the Art of Negotiation

Many bills and services are negotiable. Don’t accept the first price offered for cable, internet, phone plans, or even rent in some cases.

What you can negotiate:

- Cable and internet bills

- Cell phone plans

- Credit card interest rates

- Medical bills

- Subscription services

- Service fees

10. Build Multiple Income Streams

Saving money is easier when you have more money coming in. Side hustles and passive income streams can significantly boost your savings rate.

Income-boosting ideas:

- Freelancing in your skill area

- Selling items online

- Rideshare or delivery driving

- Tutoring or teaching

- Creating digital products

- Investing in dividend stocks

11. Automate Your Savings

Pay yourself first by automating transfers to savings accounts. When savings happen automatically, you’re less likely to skip them.

Automation strategies:

- Set up automatic transfers on payday

- Use employer 401k contributions

- Round-up savings programs

- Automatic investment contributions

- Separate savings accounts for different goals

12. Take Advantage of Employer Benefits

Many employees miss out on valuable benefits that could save significant money.

Underutilized benefits:

- Health Savings Accounts (HSAs)

- Flexible Spending Accounts (FSAs)

- Employee discounts

- Professional development funds

- Commuter benefits

- Life insurance options

13. Reduce Energy Costs at Home

Small changes in energy usage can lead to substantial savings on utility bills.

Energy-saving tips:

- Use programmable thermostats

- Switch to LED light bulbs

- Unplug electronics when not in use

- Use energy-efficient appliances

- Improve home insulation

- Take shorter showers

14. Buy Quality Items That Last

While cheap items might save money upfront, quality purchases often provide better long-term value.

Investment purchases:

- Quality shoes and clothing

- Durable kitchen appliances

- Well-made furniture

- Reliable vehicles

- Good mattresses and bedding

15. Use the Library and Free Resources

Libraries offer much more than books. They provide free internet, computer access, classes, and entertainment.

Library resources:

- Free book and movie rentals

- Computer and internet access

- Educational classes and workshops

- Meeting spaces

- Research databases

- Children’s programs

16. Practice Strategic Gift Giving

Holidays and special occasions can strain budgets. Plan ahead and get creative with gift-giving.

Gift-saving strategies:

- Set annual gift budgets

- Shop sales throughout the year

- Make homemade gifts

- Give experiences instead of items

- Participate in gift exchanges

- Focus on meaningful rather than expensive gifts

17. Maintain Your Belongings

Proper maintenance extends the life of your possessions and prevents costly replacements.

Maintenance habits:

- Regular car maintenance

- Clean and care for clothing properly

- Maintain household appliances

- Keep electronics clean and protected

- Seasonal home maintenance

18. Use Generic and Store Brands

Generic brands often provide the same quality as name brands at significant savings.

Best generic purchases:

- Medications and vitamins

- Basic groceries (rice, pasta, canned goods)

- Cleaning supplies

- Personal care items

- Basic clothing items

19. Plan Major Purchases Strategically

Timing major purchases around sales cycles can save hundreds or thousands of dollars.

Best times to buy:

- Electronics during Black Friday

- Appliances during spring and fall

- Cars at model year-end

- Clothing at end-of-season sales

- Furniture during clearance events

20. Avoid Debt and Pay Off Existing Debt

High-interest debt destroys wealth-building efforts. Focus on eliminating debt to free up money for savings.

Debt payoff strategies:

- Debt avalanche method (highest interest first)

- Debt snowball method (smallest balance first)

- Debt consolidation

- Balance transfer credit cards

- Side hustle income directed to debt

21. Take Care of Your Health

Healthcare costs can quickly drain savings. Preventive care is much less expensive than treating serious conditions.

Health savings strategies:

- Regular preventive care

- Maintain healthy lifestyle habits

- Use generic medications when possible

- Shop around for medical procedures

- Take advantage of health screenings

22. Learn DIY Skills

Basic DIY skills can save money on repairs and maintenance.

Useful DIY skills:

- Basic home repairs

- Simple car maintenance

- Clothing alterations

- Basic plumbing and electrical work

- Gardening and landscaping

23. Use Technology to Your Advantage

Technology can help automate savings and find better deals.

Money-saving technologies:

- Price comparison apps

- Automatic savings apps

- Bill tracking software

- Investment apps

- Expense tracking tools

24. Create Sinking Funds for Known Expenses

Sinking funds help you save gradually for predictable expenses instead of using emergency funds or credit cards.

Sinking fund categories:

- Holiday gifts

- Car maintenance and repairs

- Home maintenance

- Vacation funds

- Insurance deductibles

- Annual subscriptions

25. Review and Adjust Regularly

Money-saving strategies need regular review and adjustment as your life circumstances change.

Regular review schedule:

- Monthly budget reviews

- Quarterly subscription audits

- Annual insurance shopping

- Yearly financial goal assessment

- Regular savings rate evaluation

Building Long-Term Wealth Through Smart Saving

Saving money is just the first step in building long-term wealth. Once you’ve established good saving habits, focus on growing your money through investments.

Wealth-building progression:

- Build emergency fund (3-6 months expenses)

- Pay off high-interest debt

- Maximize employer 401k match

- Build larger emergency fund if needed

- Invest in tax-advantaged accounts (IRA, HSA)

- Invest in taxable investment accounts

- Consider real estate and other investments

Investment basics for beginners:

- Start with low-cost index funds

- Diversify across different asset classes

- Invest consistently over time

- Keep investment fees low

- Don’t try to time the market

- Reinvest dividends automatically

Common Money-Saving Mistakes to Avoid

Even with good intentions, people make common mistakes that sabotage their savings efforts.

Mistakes to avoid:

- Setting unrealistic savings goals

- Not having a specific purpose for savings

- Keeping all savings in low-interest accounts

- Ignoring small expenses that add up

- Not tracking progress regularly

- Giving up after small setbacks

- Focusing only on cutting expenses without increasing income

Tools and Apps for Saving Money

Technology makes saving money easier than ever. Use these tools to automate and optimize your savings efforts.

Budgeting apps:

- Mint (free comprehensive budgeting)

- YNAB (You Need A Budget)

- Personal Capital (investment tracking)

- PocketGuard (spending limits)

Savings apps:

- Acorns (round-up investing)

- Qapital (automatic savings)

- Digit (AI-powered savings)

- Yolt (expense tracking)

Shopping and deal apps:

- Honey (automatic coupons)

- Rakuten (cashback)

- Ibotta (grocery rebates)

- Flipp (price comparison)

Creating Your Personal Money-Saving Action Plan

Success requires a personalized approach. Create an action plan that fits your specific situation and goals.

Action plan steps:

- Calculate your current savings rate

- Set specific, measurable savings goals

- Choose 5-10 strategies to implement first

- Set up automatic systems where possible

- Track progress monthly

- Adjust strategies as needed

- Celebrate milestones

Sample 30-day challenge:

- Week 1: Track all expenses and create budget

- Week 2: Cancel unused subscriptions and negotiate bills

- Week 3: Set up automatic savings and meal plan

- Week 4: Research investment options and set long-term goals

The Psychology of Successful Savers

Understanding the mindset of successful savers helps develop lasting habits.

Successful saver characteristics:

- Focus on long-term goals over short-term desires

- View saving as paying themselves first

- Automate good financial habits

- Regularly educate themselves about money

- Celebrate progress and milestones

- Learn from financial mistakes

- Maintain balance between saving and enjoying life

Conclusion

Saving money doesn’t have to mean living like a hermit or giving up everything you enjoy. It’s about making intentional choices with your money and creating systems that work for your lifestyle. Start with a few strategies that feel manageable, then gradually add more as these become habits.

Remember that small changes compound over time. Saving an extra $100 per month might not seem like much, but over 10 years with compound growth, it could become $20,000 or more. The key is to start now, be consistent, and stay focused on your long-term financial goals.

Your future self will thank you for the money-saving habits you build today. Whether your goal is financial independence, homeownership, travel, or simply having peace of mind, these strategies will help you get there faster while still enjoying your life along the way.

The journey to financial freedom starts with a single dollar saved. Take action today, and begin building the wealth and security you deserve.

Content Quality Rating Framework Evaluation

Initial Screening Results

- Purpose Assessment: Clear

- Harmful Content Check: Pass

- YMYL Assessment: Yes

- YMYL Category: Financial Security

Executive Summary

- Overall Score: 85/100

- Quality Level: Strong

- Critical Issues: None identified

- YMYL Status: Pass

Detailed Evaluation

(1) Purpose & Creation Assessment

Score: 88/100 | Priority: low

The content demonstrates clear beneficial purpose â helping readers save money and build financial security. The article shows significant original effort with comprehensive coverage, practical strategies, and actionable advice tailored to Gen Z audiences.

Issues:

- Could benefit from more specific data citations

- Some strategies could include more detailed implementation steps

- Meta description could be more compelling

Recommendations:

- Add specific statistics with sources for savings amounts

- Include step-by-step implementation guides for top strategies

- Enhance meta description with stronger call-to-action

(2) E-E-A-T Assessment

Score: 82/100 | Priority: medium

The content demonstrates solid expertise in personal finance with practical, well-established advice. However, as YMYL financial content, it could benefit from stronger authority indicators and more expert validation.

Issues:

- No clear author credentials displayed

- Limited expert source citations

- Could use more authoritative financial institution references

Recommendations:

- Add author bio with relevant financial credentials

- Include quotes or references from certified financial planners

- Reference data from authoritative sources (Federal Reserve, Bureau of Labor Statistics)

(3) Content Quality

Score: 87/100 | Priority: low

The content shows high effort and originality with comprehensive coverage of money-saving strategies. Writing is clear, well-organized, and appropriate for the target audience.

Issues:

- Some strategies could be more detailed

- Could benefit from more specific examples

- Missing some current financial trends (2025 context)

Recommendations:

- Add specific dollar amounts for potential savings

- Include real-world examples and case studies

- Update with 2025-specific financial challenges and opportunities

(4) User Value

Score: 89/100 | Priority: low

The content provides excellent practical value with actionable strategies that readers can implement immediately. Good balance of comprehensive coverage while remaining accessible.

Issues:

- Could include more immediate action items

- Progress tracking methods could be more specific

- Missing comparison of strategy effectiveness

Recommendations:

- Add quick-start checklist for immediate implementation

- Include templates for budgeting and tracking

- Rank strategies by potential impact and ease of implementation

Quality Indicators

- High Quality Elements: Comprehensive coverage, practical advice, good organization, appropriate tone for audience, actionable strategies

- Issues Identified: Limited expert citations, could use more specific data, some implementation details could be enhanced

Recommendations

- Add author credentials and expert source citations to strengthen E-A-T

- Include specific statistics and data from authoritative financial sources

- Enhance implementation details with step-by-step guides and templates

Improvement Checklist

â¡ Add author bio with financial expertise credentials â¡ Include citations from Federal Reserve, BLS, and other authoritative sources â¡ Add specific dollar amounts for potential savings from each strategy â¡ Create downloadable budget templates and tracking sheets â¡ Include expert quotes from certified financial planners â¡ Add 2025-specific financial context and challenges â¡ Enhance meta description with stronger call-to-action â¡ Create quick-start implementation checklist â¡ Add progress tracking methodology â¡ Include strategy effectiveness rankings

Featured Image Prompt (16:9 ratio)

“A modern, clean illustration showing a diverse group of young adults (Gen Z) around a large piggy bank with dollar signs floating around it. Include elements like a smartphone with savings apps, shopping bags, a coffee cup, and coins/bills. Use a bright, optimistic color palette with blues, greens, and gold accents. The background should show subtle financial symbols like charts trending upward. Style should be contemporary and engaging, avoiding overly corporate aesthetics. 16:9 aspect ratio, high quality, professional illustration.”;;

Infographic Prompts

1. “25 Money-Saving Strategies Infographic”;;

“Create a visually appealing infographic displaying 25 money-saving strategies in a grid or circular layout. Each strategy should have a small icon and brief title. Use colors like blue, green, and gold. Include categories: Budget Basics, Smart Shopping, Lifestyle Changes, Income Boosters, and Long-term Wealth. Make it easy to scan and share on social media. Include the title ’25 Ways to Save Money in 2025â² at the top.”;;

2. “Monthly Savings Potential Breakdown”;;

“Design an infographic showing potential monthly savings from different strategies: Meal planning ($200-400), Subscription audit ($50-100), Energy efficiency ($30-80), Negotiating bills ($40-120), Using coupons/cashback ($60-150). Use bar charts or pie charts with dollar amounts clearly displayed. Include a total potential savings calculation at the bottom. Use engaging colors and clear typography.”;;

3. “Building Your Emergency Fund Timeline”;;

“Create a step-by-step timeline infographic showing how to build a 6-month emergency fund. Start with $1,000 initial goal, then $2,500, $5,000, and finally 6 months of expenses. Include timeframes (3 months, 6 months, 1 year, 18 months) and specific savings amounts needed monthly. Add visual progress bars and motivational elements. Use a color gradient from red (start) to green (complete).”;;